- Lemonade Stand Finance

- Posts

- Key Concepts from One Up On Wall Street

Key Concepts from One Up On Wall Street

One Up On Wall Street: Key Concepts Simplified

Peter Lynch managed the legendary Fidelity Magellan fund for 13 years where he averaged 29% returns. He beat the S&P 500 11 time out of 13 and grew assets under management from $20 million to over $14 billion. This run built him a legacy of being one of the greatest investors of all time.

Lynch didn’t use a secretive investment strategy that only genius finance minds could understand. He used simple strategies and argued that the average investor can beat the pros by using what they know.

In his classic “One Up On Wall Street,” Lynch argued that by paying attention to the world around us and the products and services we encounter every day, the average person can find companies to invest in before the Wall Street analysts do. When investors get in before the pros do, they can find stocks that appreciate 10x in value.

Here are the top lessons from One Up On Wall Street:

Understand the nature of the companies you own and the specific reasons for holding the stock. (“It is really going up!” doesn’t count.)

Don’t buy a stock because a chart pattern tells you its going up, or because your friend said so.

Understand the Company behind the stock and why that stock is worth owning.

Ask yourself what is the exact reason why the stock you own is undervalued. Maybe the growth potential is being overlooked by the market, there are hidden assets, or you like the dividend yield.

Lynch specifically likes stocks with little Wall Street following because there is a good chance something important is being overlooked.

People get incredibly valuable fundamental information from their jobs that may not reach the professionals for months or even years.

You have an edge over every other stock market participant when it comes to stocks in the industry you work in.

Because new information about your industry reaches you before it reaches Wall Street.

If you own a Goodyear tire store and after many years of poor sales you suddenly can’t keep up with orders. It’s a strong signal that Goodyear stock may be about to rise.

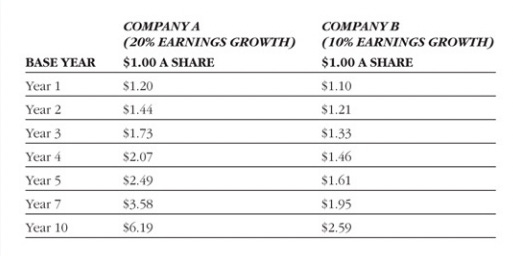

Don’t always buy the stock with the lower p/e ratio

Factor in growth when you are looking at the p/e ratio.

All else being equal, a 20% grower selling at 20x earnings is a better buy than a 10% grower selling at 10x earnings.

Companies that have no debt can’t go bankrupt.

There is ~1 recession every 6 years and unexpected, negative economic shocks happen from time to time.

Poor economic condition will reduce a companies profits & thus their ability to service their debt, often leading to bankruptcy in companies with poor financial health.

Furthermore, if you are buying stocks in troubled companies seek the ones without debt.

The floor of a stock is typically its net cash position (cash - total liabilities) because this is the cash shareholders have a claimb on. So in a worst case scenario, the Company could buy back all its stock for the amount of net cash it has on its balance sheet. Stocks with no debt typically have higher net cash positions.

Long shots almost never pay off

$500 million in cash from selling shares, 100 Phd’s, 10 celebrity investors and $0 in revenue.

Remember SPACs? They tried to sell us on fairy-tail stories with no numbers to back them up.

These long shot Companies give you a small chance to make a lot of money, but 99% of the time you lose all of your money. Best to avoid them.

Just because a company is doing poorly doesn’t mean it can’t do worse.

If a stock goes down 99% it can go down another 100%.

The same goes for the profits of a business. Don’t buy something because you think it can’t get any worse.

Understand the fundamental situation to see if improvements are being made.

Avoid hot stocks in hot industries.

High growth and hot industries attract a smart, rich and fast acting crowd that want’s to take a share of the profits.

Unless the company has an economic moat, the industry will soon be filled with competitors, resulting in decreased profit margins for everybody.

Remember the concept of perfect competition from your economics 101 class next time you are tempted to buy a hot stock in a hot industry.

The two minute drill

Before buying a stock give a two minute monologue that covers the reasons you are interested in it, what needs to happen for it to succeed, and the pitfalls in the pitch

Once you’re able to tell the story of the stock so that even a child can understand it, then you have a proper grasp on the situation.

Big companies have small moves, small companies have big moves.

A successful new soft drink that generates $1 billion in earnings will have almost no affect on the value of Coke’s stock.

The same product would significantly increase the value of the stock in a small soft drink Company.

When in doubt, tune in later.

If the prospects of as stock with little earnings history are so phenomenal, then they will still be phenomenal the next year and the year after that.

Don’t just trust in the story, put off buying the stock until it has an established earnings record.

You may miss the first move, but you can get 10 baggers in stocks that have proven themselves.